Hi

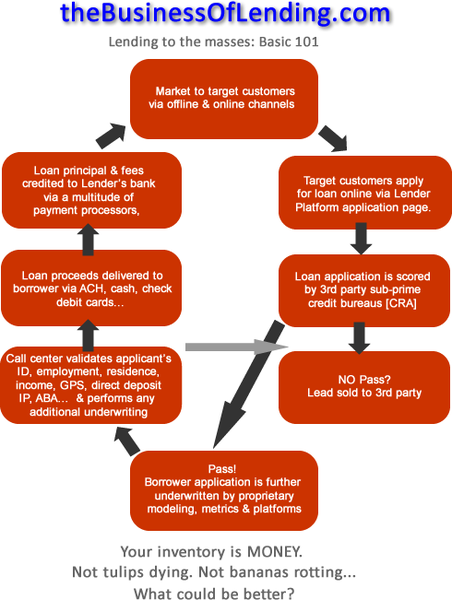

Here's a very basic visual reminder of your "Loan Flow," and a few target KPIs for Lenders. [PS: No longer interested? Unsubscribe https://www.aweber.com/z/r/?ThisIsATestEmail

GENERALLY [Online KPIs vs. Storefront vary]:

- We're a $500 Billion dollar market

- If you could get to .01% market share OMG!

- Our market size is scaling into

2023/2024...

- Competitors are abandoning ship [Cost of capital, legal, obsolete, online loan originations are taking market share, failure to embrace mobil phone offerings...]

- No lender serving our demographic has >3% market share [And yet Enova is originating nearly $1Billion dollars/quarter!]

- Underwriting

platforms are much more sophisticated today

- Reacts should be 40% of your loan originations

- CAC = $130 all in.

- You must get in front of your applicant 1st to convert

- Customer has multiple loans? Ability to pay? Roll them

up

- Your Team should be converting 25% of applicants who pass front end underwriting

- To fund 12 loans/day = 2 collectors & 1 sales person [They can work from home]

- 13% of top line revenue = expenses.

- 18% - 20% cost of capital is the

market

- Our loans <12 months. We can react to macro events fast

- Referral programs work! Implement them.

- I've a LOT of interesting opportunities for investors, operators, acquirers... Email me at: TrihouseConsulting@gmail.com

- FINALLY, if you don't have our recently updated "bible," download a copy now!