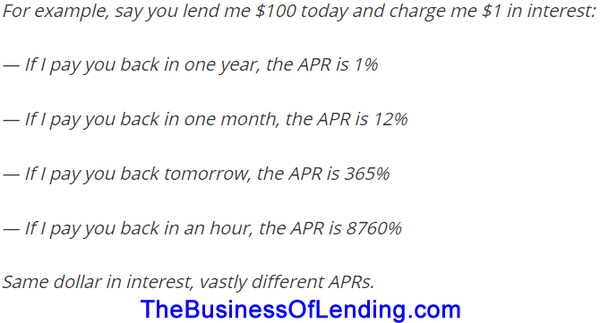

A 36% APR on a 2-week loan = customers pay $1.38 per $100

borrowed. FALLACY #1: Payday lenders, car title lenders, installment lenders, and all small-dollar loan lenders can earn a profit under a state-imposed 36% annual percentage rate cap.

FALLACY #2: Small-dollar loan customers should simply go to a bank rather than me. My worst critic knows that banks DO NOT WANT my customer! Banks think my customer is a giant PAIN! My customers are not comfortable inside a bank. If you’ve visited a bank lately, you know it requires an act of god to even

talk with a banker. Fuhgeddaboudit!

FACT: A report by Professor Victor Stango, “…a 36 percent cap eliminates payday loans. If payday lenders earn normal profits when

they charge $15 per $100 per two weeks, as the evidence suggests, they must surely lose money at $1.38 per $100 (equivalent to a 36 percent APR.)”–Economists Robert DeYoung, Ronald Mann, Donald Morgan, and Michael Strain, Federal Reserve Bank of NewYork

WRONG! So-called consumer protectionists and competitors [think pawn shops, banks, credit unions, and lenders servicing 640+ FICO consumers via long-term, $3000+ loans] lobby hard for capping interest rates at 36%.

A 36% Annual Percentage Rate Cap in the real world = - $100 borrowed would generate $1.38 per month in

interest.

- That’s equivalent to $.10 per day.

- A $100,000 “book” [portfolio – “money on the street,” would

earn $36,000 per year in top line revenue.

- In other words, $36,000 per year or $3000 per month GROSS.

The Reality? - I cannot pay my storefront rent with $3000 in monthly fee

revenue with a $100,000 portfolio!

- I need 2.5 employees. [How much $$$$ in wages and benefits is that in your locale?]

- My average cost of capital is 12%.

- Bad debt. My net chargeoffs are 18%.

- My CAC is $185.

- Additional line item expenses include insurance, security, underwriting, phones, utilities, licensing, state audit fees, collections, text messaging fees, and loan mngt. fees, office expenses…

- Taxes.

- Accounting, legal & professional fees.

- Unlike credit unions, various community groups & banks, my business is NOT subsidized.

- While my competitors technically provide <36% loans to a

limited pool of subprime consumers, they evade the 36% APR cap by selling expensive insurance products to their customers, products that are NOT included in the loan’s APR calculation. The result? 180%+ APRs.

- My customers WANT & NEED my loan products! They know my loan product is expensive. I tell them it’s expensive. The fees I charged are plastered all over the walls of my store and on my website. My team doesn’t hide our fees. EVER! There is

no need.

- My customers desire loans of $100 – $500. Who is going to take a chance on them? Not a bank? Not a credit union. Their friends and family, who my customer is too embarrassed to ask for a loan, are OFTEN in the same boat. Where to turn in an

emergency? Food, Car repair, medicine, rent…

- Is a national 36% APR cap going to happen in the USA? NOT A CHANCE!

LEARN HOW TO START A CONSUMER LOAN BUSINESS! YOUR INVENTORY

IS MONEY! WHAT COULD BE BETTER? ZIP!- Grab a copy of our "bible:" How to Loan Money to the Masses Profitably!

- Free 30 Minute "Discovery Call." Are we a good fit?

- Serious, in-depth consultation with our Founder.

- Texas lenders! Invest in our "Texas CAB/CSO

Analysis."

Was my bimonthly Newsletter about lending money to the Masses forwarded to you? Signup: Newsletter |

|

|