THE CASE FOR PAYDAY LOANS

1. Accessibility for the

Credit-Challenged

Payday loans provide quick and easy access to cash for individuals who might not qualify for traditional loans due to poor credit histories.

This accessibility can be a critical lifeline during financial emergencies, such as unexpected medical

bills or urgent car repairs.

2. Speed and Convenience

The application process for payday loans is typically fast, with many lenders offering same-day approval and funding.

This speed

is vital for those who need money immediately and cannot afford to wait for a traditional loan approval process.

3. No Need for Credit History

Payday lenders do not require a strong credit history, making these loans accessible to a broader

demographic.

This inclusivity ensures that even those who have made financial mistakes in the past can access the funds they need.

4. Regulation and Transparency

Contrary to popular

belief, the payday loan industry is regulated both at the state and federal level.

For instance, in Texas, the Office of Consumer Credit Commissioner (OCCC) monitors payday lenders to ensure

compliance with state laws. Fees and terms are disclosed upfront, providing transparency that helps consumers make informed decisions.

The Predatory Argument

1.

Exorbitant Interest Rates

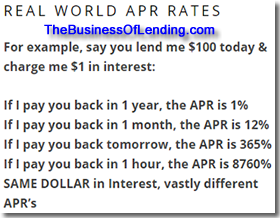

Critics argue that the high interest rates charged by payday lenders are exploitative. For example, a typical payday loan can carry an annual percentage rate (APR) of over 400%【7†source】. Such rates can make it difficult for borrowers to repay the loan, leading to a cycle of debt.

2. Debt Traps

Many payday loan borrowers need more time to repay the initial loan, leading to rollovers and additional fees. This cycle can trap borrowers in a continuous debt loop, with each new loan taken out to repay the previous one.

3. Targeting the Vulnerable

Payday lenders often target low-income individuals who are already struggling financially. The easy availability of these loans can lead borrowers to make poor financial decisions, exacerbating their financial woes.

4. Lack of Long-Term Solutions

While payday loans provide short-term relief, they do not address the underlying financial issues that lead individuals to need such loans in the first place. This lack of a long-term solution can leave borrowers in a worse financial position than before.

Counterarguments to the Criticism

1. Regulation Mitigates Abuse

The argument that payday loans are unregulated and predatory does not hold in states like Texas, where the

OCCC ensures that lenders comply with strict guidelines. Transparency in fees and terms allows borrowers to understand the costs involved.

2. Financial Literacy is Key

The cycle of debt often results from a lack of financial literacy rather than the loan

itself. Increasing financial education can help borrowers make better decisions and use payday loans responsibly.

3. Not All Borrowers Fall into Debt Traps

Many payday loan borrowers use these loans responsibly and repay them on time. These loans can

provide a crucial stopgap during financial emergencies without leading to long-term debt for all users.

4. Alternatives are Limited

For many individuals, payday loans are the only available option. Traditional banks and credit unions often turn away those

with poor credit, leaving payday lenders as the only source of quick cash.

Conclusion

The payday loan industry is undoubtedly controversial, with strong arguments on both sides.

While it is essential to recognize the potential for exploitation and the need for regulation, it is equally important to acknowledge the role payday loans play in providing critical financial access to those who need it most.

Instead of vilifying payday loans

outright, a more balanced approach involving regulation, transparency, and financial education could help ensure these loans serve their intended purpose without trapping borrowers in a cycle of debt.

WHAT DO YOU THINK? ARE PAYDAY LOANS A NECESSARY EVIL OR A PREDATORY TRAP? SHARE YOUR THOUGHTS IN THE COMMENTS BELOW!