Challenges for Subprime Borrowers

- Consumers lack traditional options for emergency credit. Studies indicate that restrictive legislation diminishes access to credit and increases reliance on illegal or less-regulated financial products.

- Rising bankruptcy rates suggest consumers are already struggling with existing debt burdens. Further limiting liquidity options may exacerbate financial crises for these

individuals.

Opportunities for Subprime Lenders

- Expanding Product Lines: With overdraft fees becoming less viable, offering small-dollar installment loans or lines of credit could meet demand while adhering to evolving regulations.

- Tech Integration: Investing in digital platforms to attract tech-savvy borrowers who previously used overdraft protection.

- Educating Customers: Transparency

in pricing and repayment terms can build trust and appeal to regulators.

Strategic Considerations

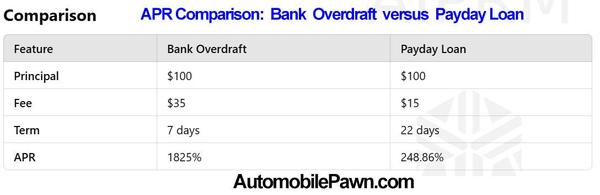

- Adaptation to CFPB Standards: Aligning products with APR transparency and affordability metrics will ensure compliance and reduce regulatory risks.

- Marketing Restrictions: Overcoming barriers like Google's 36% APR restrictions requires innovative outreach and reliance on direct channels.

- Google

Business Profile: Subprime lenders with storefronts gain an advantage over online-only lenders by leveraging Google Business Profile [GBP] to appear prominently in Google searches.

- Leveraging Bankruptcy Trends: Educating financially stressed consumers about alternative credit options before resorting to bankruptcy may

increase subprime loan adoption.

Conclusion

The CFPB's overdraft rule is both a challenge and an opportunity for the subprime lending industry.

While it may increase demand for small-dollar loans, the regulatory landscape necessitates innovation, compliance, and strategic adaptation to capture this shifting market

segment effectively.

All industry professionals feel the urgency and importance of this strategic adaptation.